[ad_1]

Nvidia Joins the $1 Trillion Club: What We Can Learn from Its Rise

Welcome to the $1 trillion club, Nvidia.

Nvidia’s stock is up more than 6% today, pushing its shares past $413 in the wake of a widely-praised earnings report.

Given that the stock market has battered tech stocks in recent quarters, how is Nvidia breaking away from the pack? What can we learn from its rise?

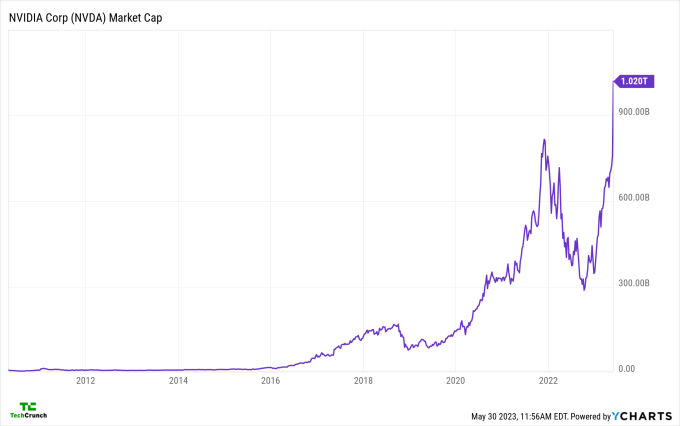

The club of trillion-dollar companies, measured by market capitalization, is so small that even Meta doesn’t make the cut today. Tesla is only 63% of the way there and Salesforce is not even worth a quarter of the required value it needs to join. To see Nvidia reach a market value of more than $1,000,000,000,000 is therefore a massive endorsement not only of its trailing operating results, but also its anticipated future. Investors expect a lot from Nvidia.

The following chart shows its ascent:

Image Credits: Ycharts

To get our minds around what’s going on, let’s go through the company’s latest earnings report, consider what it is forecasting, and discuss how investors and analysts missed the mark with their own expectations.

What is Nvidia and How Did It Reach $1 Trillion Market Value?

Nvidia is a technology company known for its graphics-processing units (GPU) and artificial intelligence (AI) computing solutions. It has become a dominant force in gaming, professional visualization, data center, and automotive industries. As of May 2022, its market capitalization surpassed $1 trillion, becoming one of the few companies to achieve this feat alongside Apple, Microsoft, and Google. Nvidia’s impressive performance can be attributed to several factors, including:

- A strong portfolio of innovative products that cater to various industries

- A successful strategy to acquire complementary businesses and technologies

- An increasing demand for its products in the gaming, AI, and data center markets

- A robust financial performance with consistent revenue growth and profitability

- A positive outlook for future growth opportunities, particularly in the AI and autonomous driving spaces

Nvidia’s Latest Earnings Report

In the first quarter of fiscal year 2024, ended April 30, 2022, Nvidia reported record revenue of $7.21 billion, up by 84% year over year. Its net income was $2.31 billion, up by 118% year over year. These numbers significantly exceeded analysts’ expectations, thanks to the company’s strong demand in gaming and data center industries, as well as a successful integration of Arm Limited, a UK semiconductor company, that Nvidia acquired for $40 billion in 2020.

What Is Nvidia Forecasting?

Nvidia’s management team predicts continued growth in its gaming, data center, and professional visualization segments, driven by expanding customer base and new product developments. The company also sees significant potential in the automotive industry, given the growing adoption of electric and autonomous vehicles that require advanced computing and AI capabilities. Moreover, Nvidia expects its acquisition of Arm Limited to increase its addressable market in the semiconductor industry and create new revenue streams.

How Investors and Analysts Missed Their Expectations

While Nvidia’s soaring stock price and financial performance are impressive, it is worth noting that some investors and analysts had underestimated the company’s potential. For instance, several analysts downgraded Nvidia’s stock in late 2021, citing concerns about supply chain disruptions, slowing demand, and increased competition. However, Nvidia managed to overcome these challenges and deliver strong results, thanks to its diversified product portfolio and strategic acquisitions.

Conclusion

Nvidia has joined the elite club of companies with a market capitalization of over $1 trillion, demonstrating its impressive growth and potential for future innovation. Its performance can be attributed to its portfolio of cutting-edge products, successful acquisitions, and robust financial results. As Nvidia continues to expand its reach in various industries and invest in new technologies, it is likely to remain a dominant force in the tech industry for years to come.

FAQs

What are Nvidia’s main products?

Nvidia is best known for its graphics-processing units (GPU) that are widely used in gaming, data center, and professional visualization industries. The company also offers artificial intelligence (AI) computing platforms, workstation graphics cards, and network adapters, among other products.

What industries is Nvidia focusing on?

Nvidia has a diversified portfolio of products that cater to various industries, including gaming, data center, professional visualization, automotive, and healthcare. The company has been investing heavily in the AI and autonomous driving spaces, seeing significant growth potential in these areas.

Why did Nvidia acquire Arm Limited?

Nvidia acquired Arm Limited, a leading UK semiconductor company, for $40 billion in 2020 to expand its reach in the semiconductor space and create new revenue streams. The acquisition allows Nvidia to access Arm’s intellectual property and chip designs, which can be integrated with Nvidia’s products, particularly in the AI and data center markets.

[ad_2]

For more information, please refer this link